This story's mobile version is still in progress. For the complete story, please visit my site on a desktop!

LestariGo

LestariGo

Modernizing the digital banking experience for one of Indonesia's largest rural banks

Modernizing the digital banking experience for one of Indonesia's largest rural banks

As digital banks started to gain popularity, Lestari Bank wanted to reinvent their mobile banking experience to remain competitive. I was brought on as the lead responsible for spearheading the redesign.

I embarked in a one-year journey researching what today's users want in a digital banking experience, creating feasible concepts for Lestari, and delivering a prototype for development—to help Lestari to make the leap from saving to transactional banking.

skills

skills

UI/UX design

Product management

Design for development

Cross-functional collaboration

UX research

Figma

Strategy

time

2022 - 2023 (1 year)

time

2022 - 2023 (1 year)

role

product manager,

UX designer,

UX researcher

role

product manager,

UX designer,

UX researcher

tools

whimsical

figma

tools

whimsical

figma

project type

UI/UX design &

product management

project type

UI/UX design &

product mgmt

team

Samantha Chandra (product lead)

Dhika Endi Astowo (UI designer)

Arik Eka (Visual designer)

Developers and IT staff

Business unit leaders and marketers

team

Samantha Chandra (product lead)

Dhika Endi Astowo (UI designer)

Arik Eka (Visual designer)

Developers and IT staff

Business unit leaders and marketers

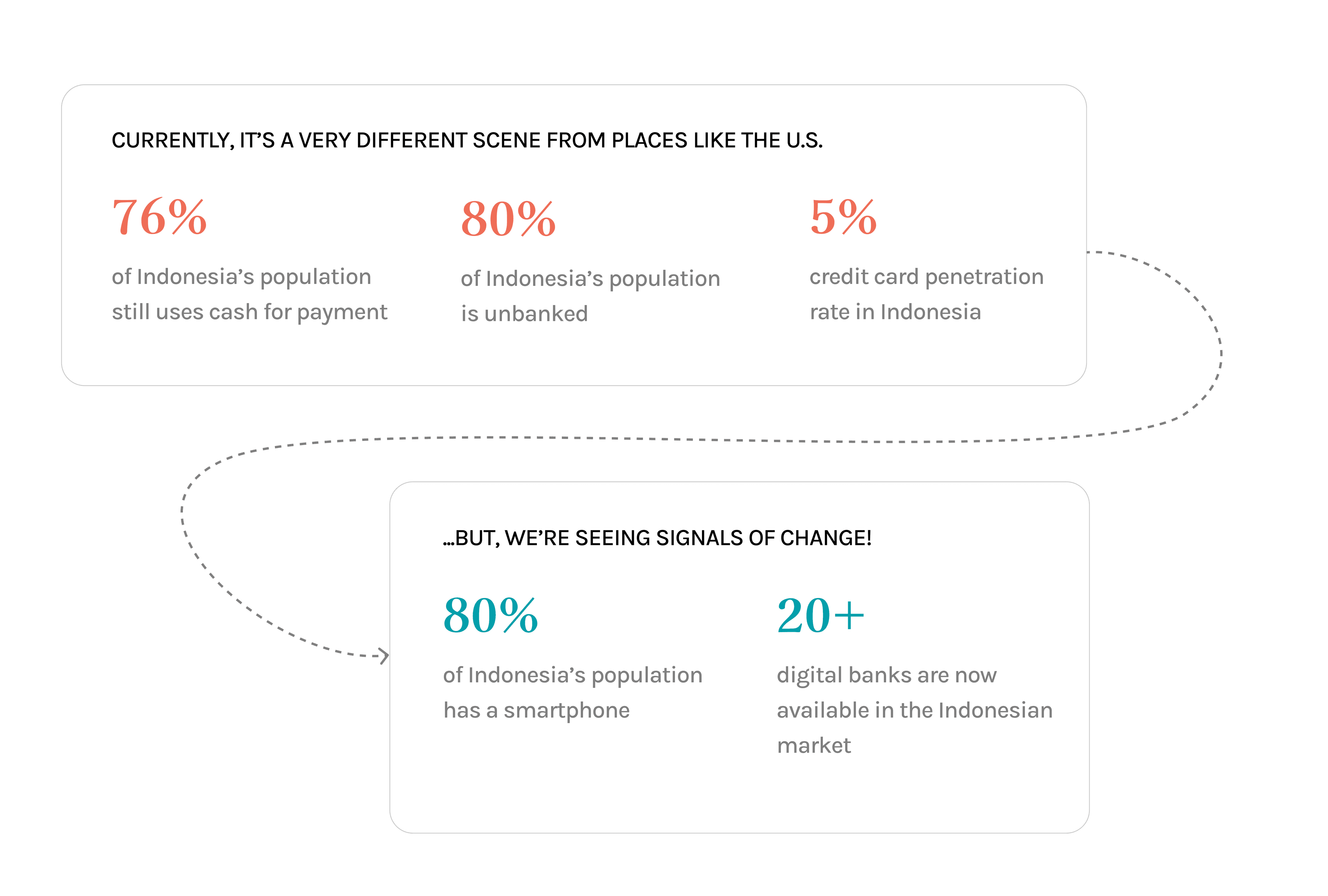

Slowly but surely:

The digital banking revolution is transitioning Indonesia into a cashless society.

SETTING THE SCENE

Replacing cash, the main payment methods now are digital wallets and bank transfers.

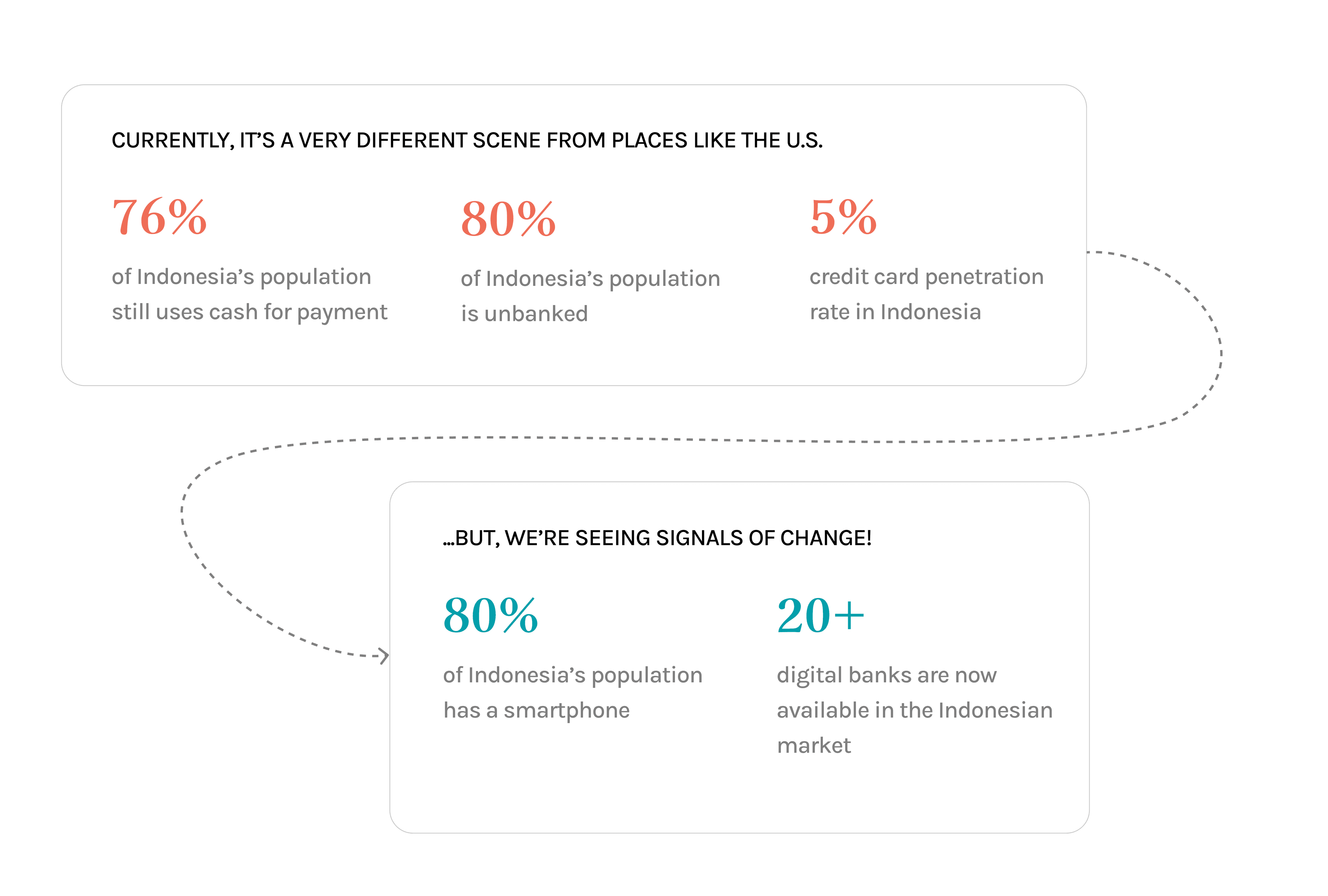

Indonesian rural banks are designed to serve the local community's needs, including micro and small-to-medium-sized businesses (MSMEs).

Rural banks are great for saving because they offer high interests, but they don't have transactional capabilities. So, almost nobody uses rural banks to do daily transactions. Because of this, rural banks have high cost of funds.

People don't use rural banks for daily transactions.

Lestari wants this to change.

Its vision is to be a go-to bank for daily transactions.

THE PROBLEM : #1

THE PROBLEM: #2

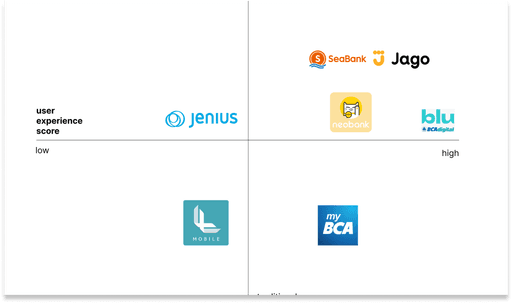

Lestari believes that the rise of digital banking is an opportunity to "catch up" with the bigger banks, as the competition is no longer about who has the largest ATM network, but who has the better digital capabilities.

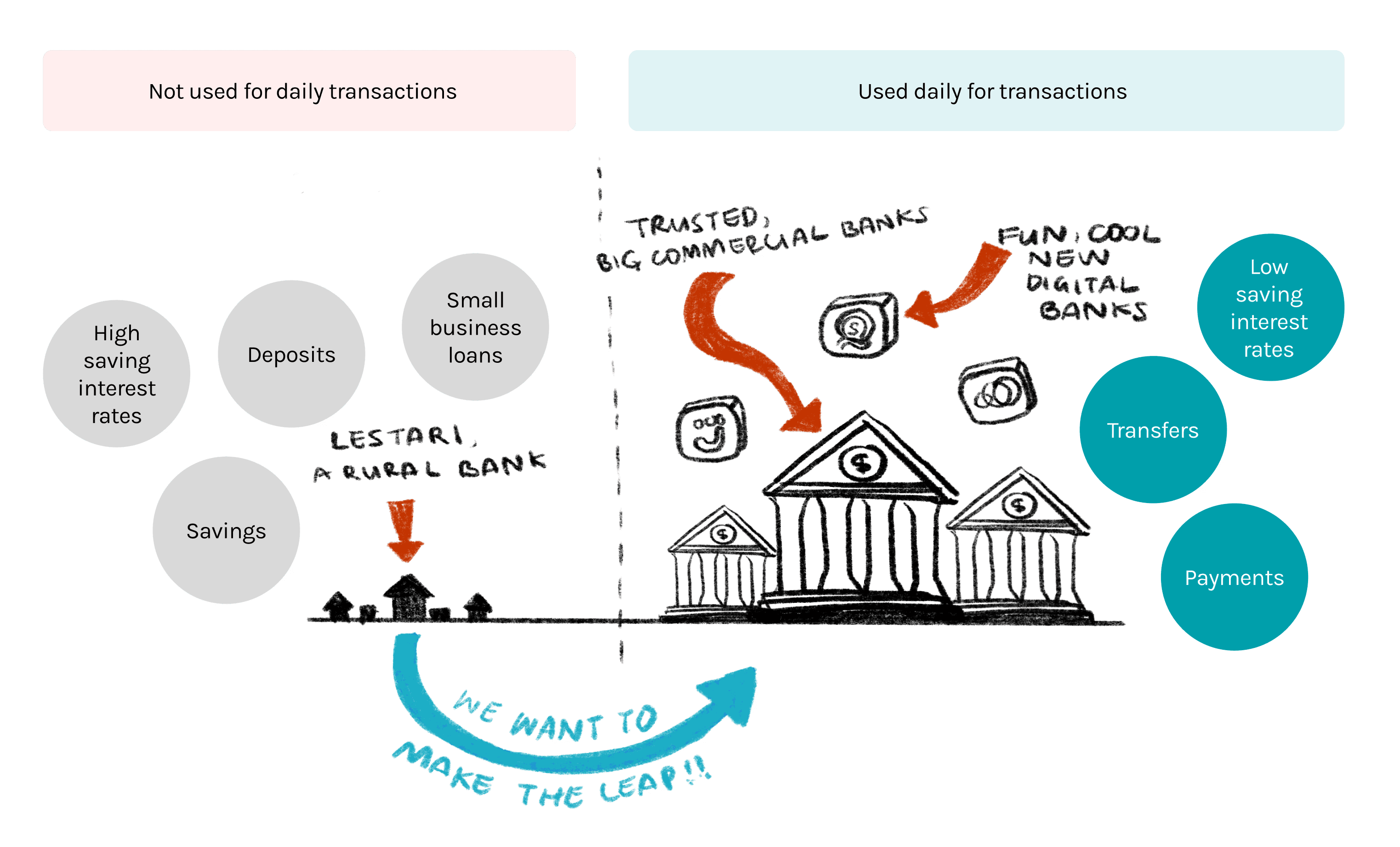

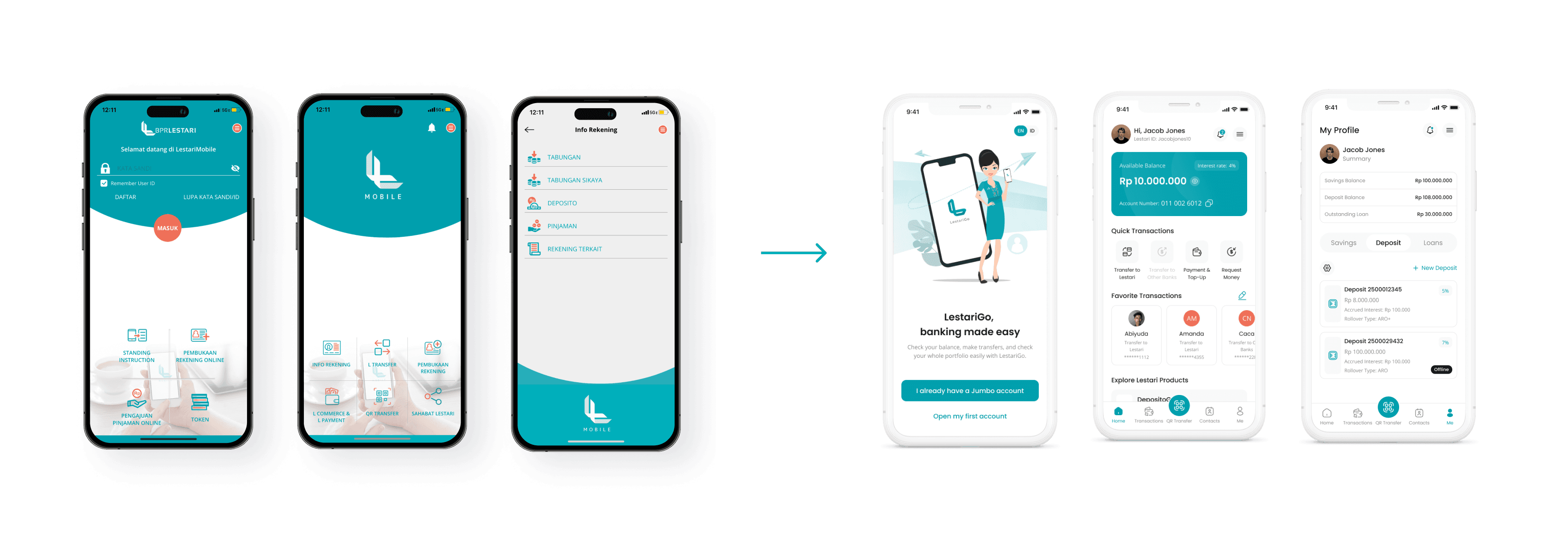

However, their current app was designed a long time ago and has not been updated since. The outdated UI and the lack of mainstream features like online onboarding made it less attractive to potential users.

Lestari's current mobile banking app is not going to get them closer to their vision.

Outdated UI

No online onboarding

No clear reason why I might use this over another bank

What kind of mobile banking experience can Lestari offer to help them make the leap from a savings bank to a transactional bank?

jump to design process

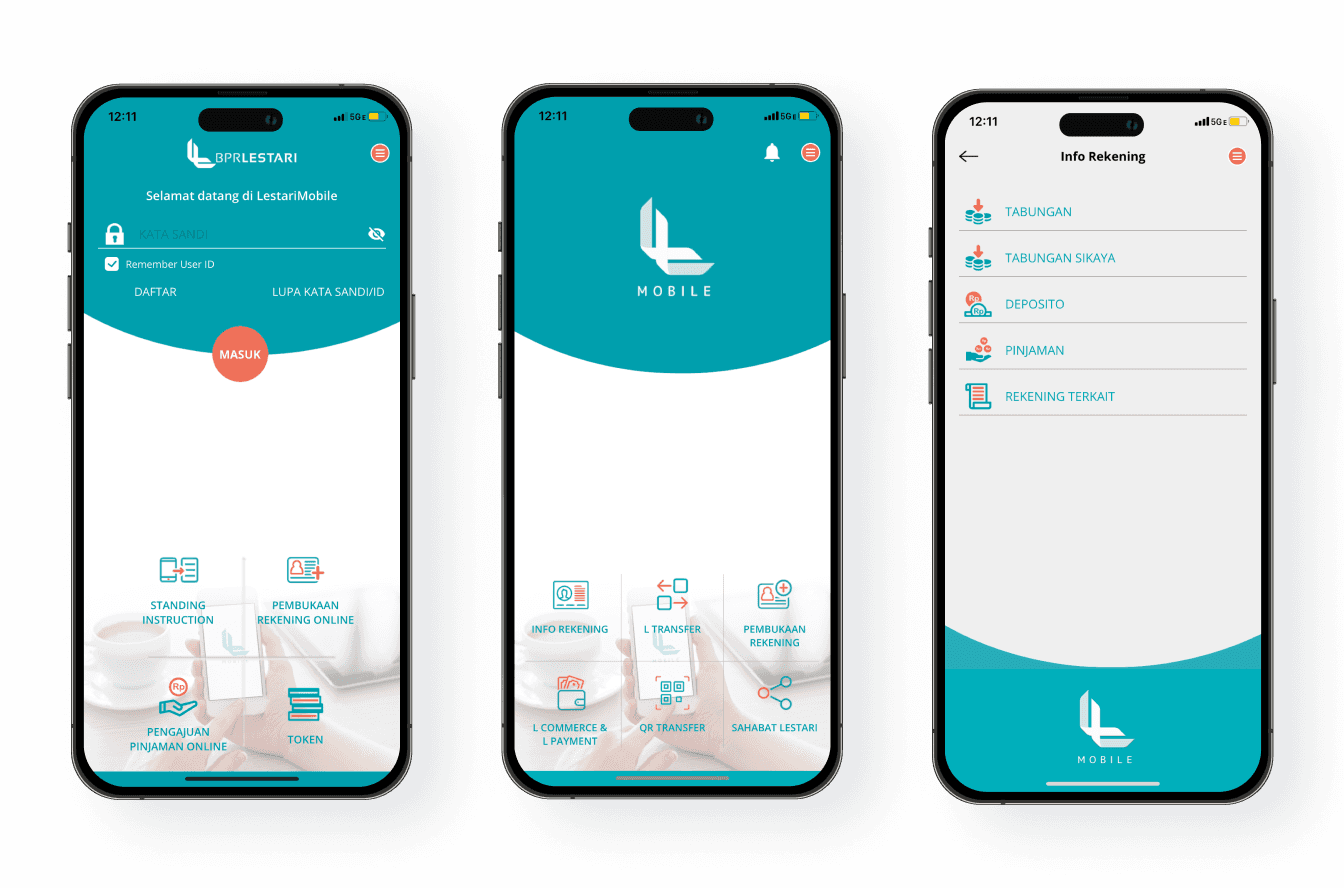

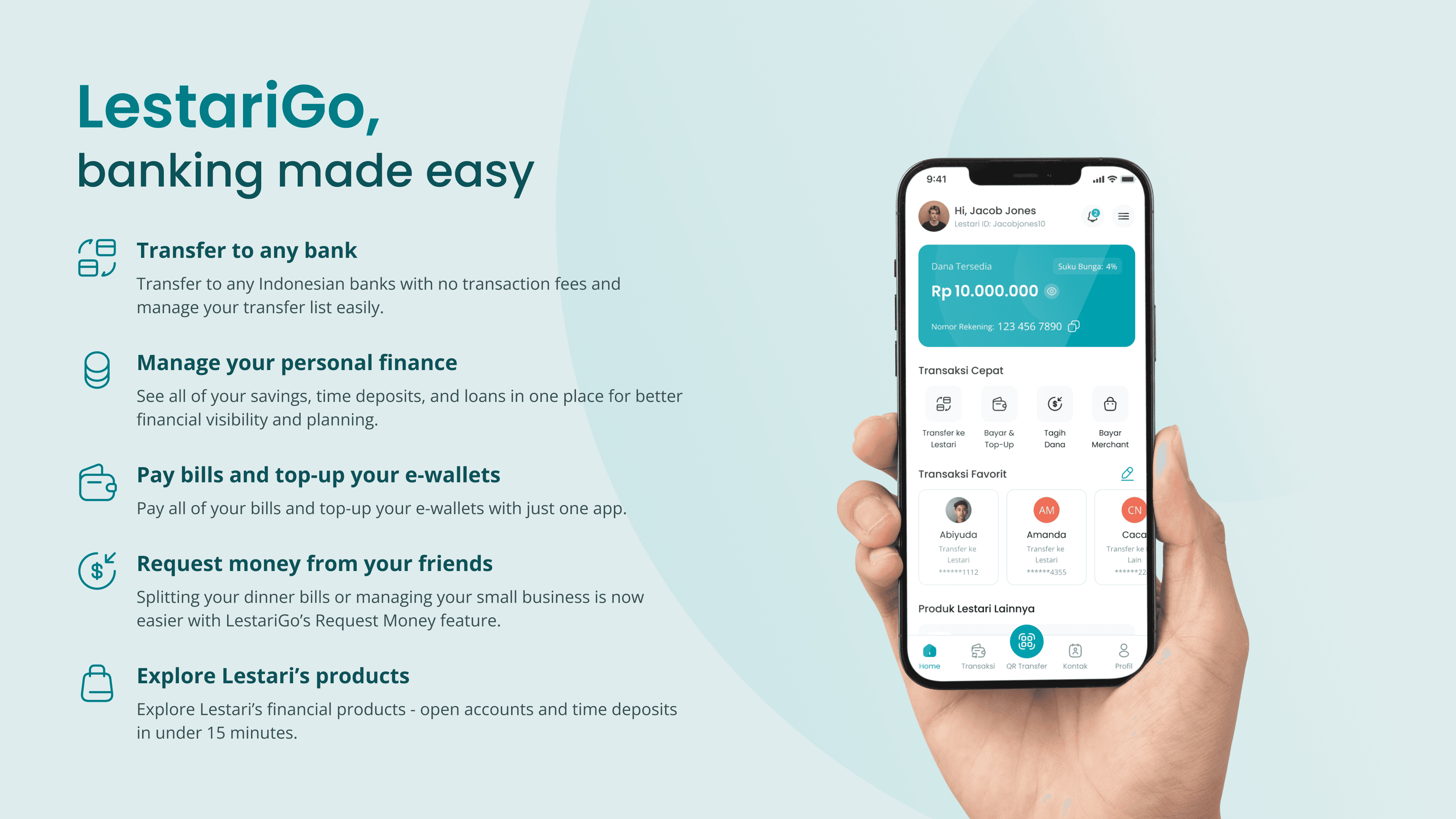

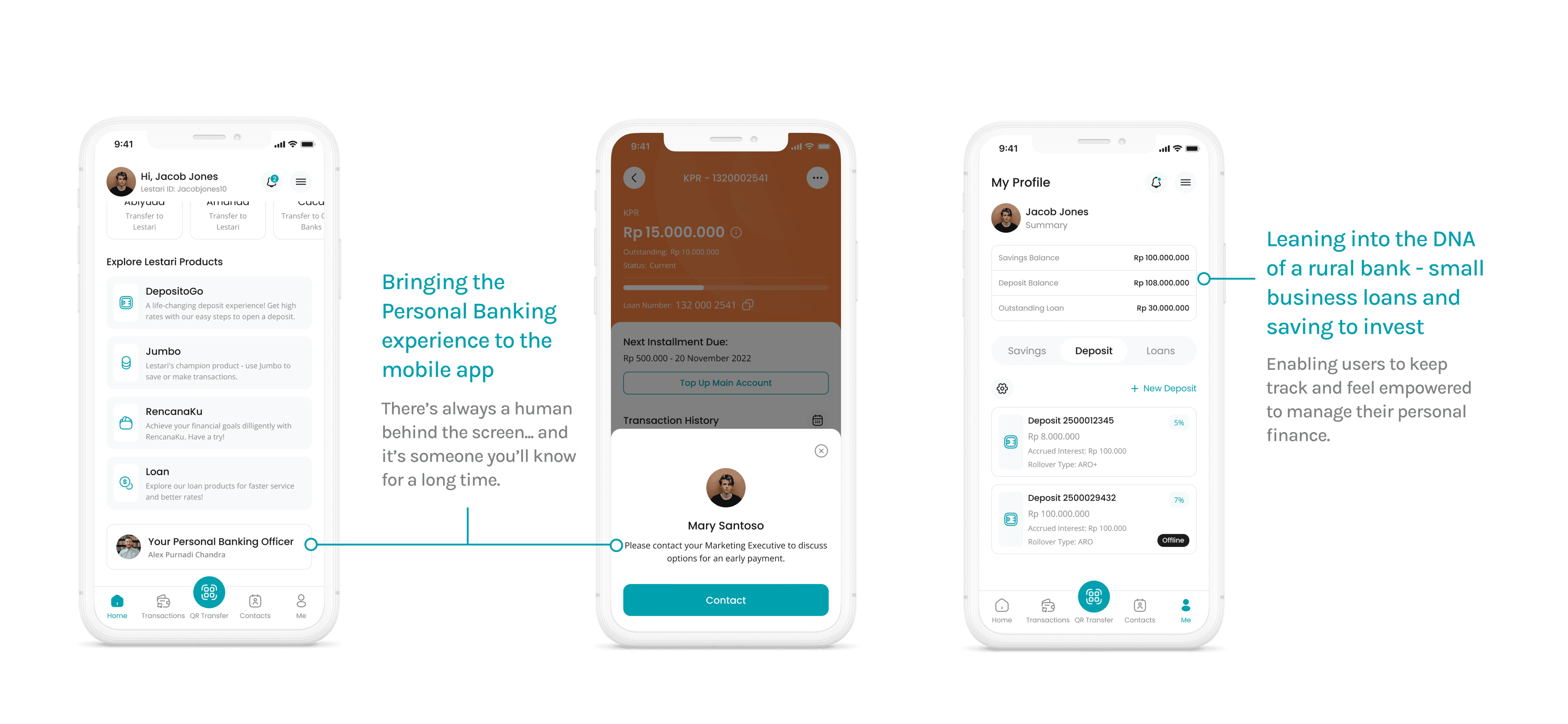

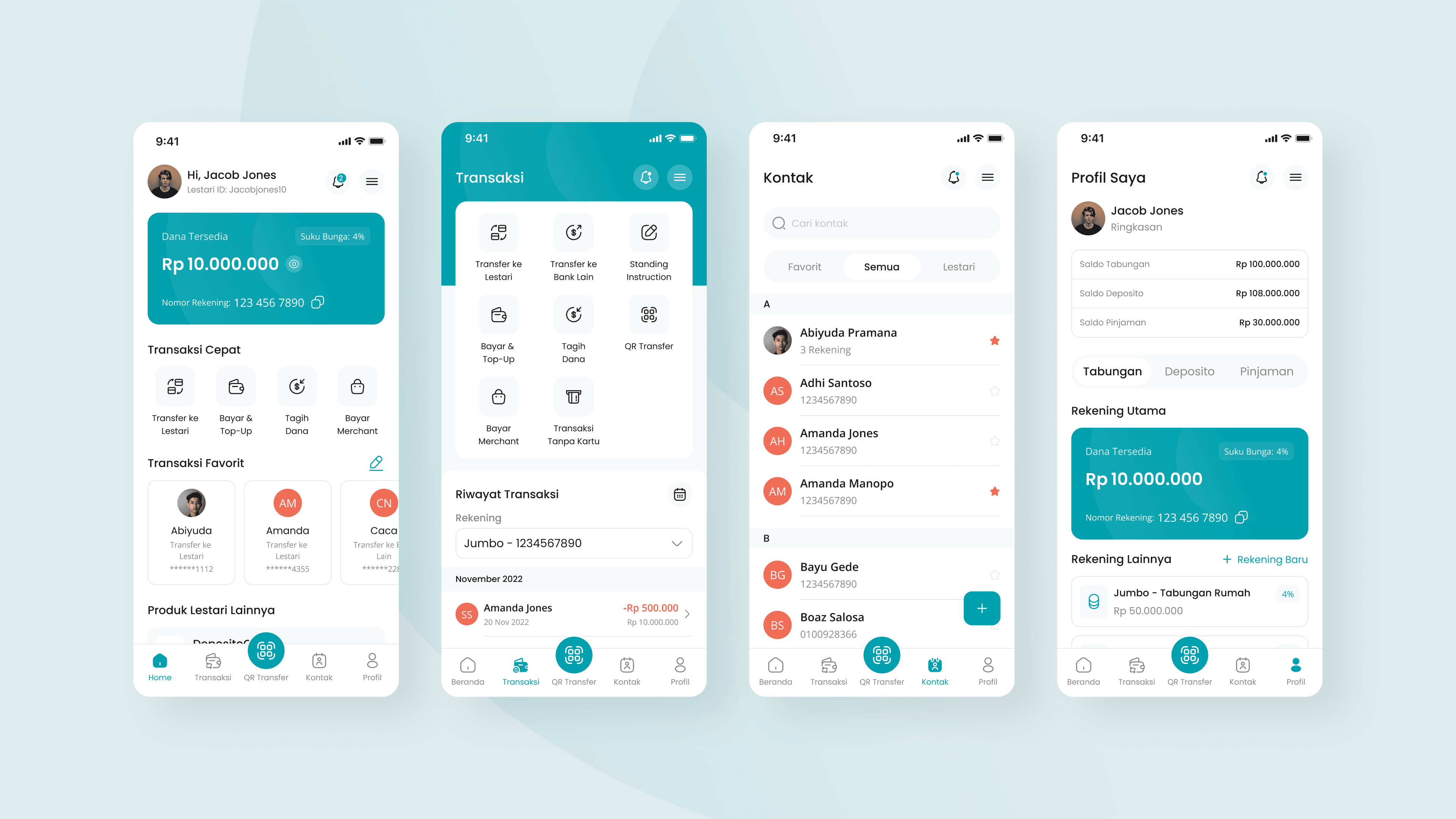

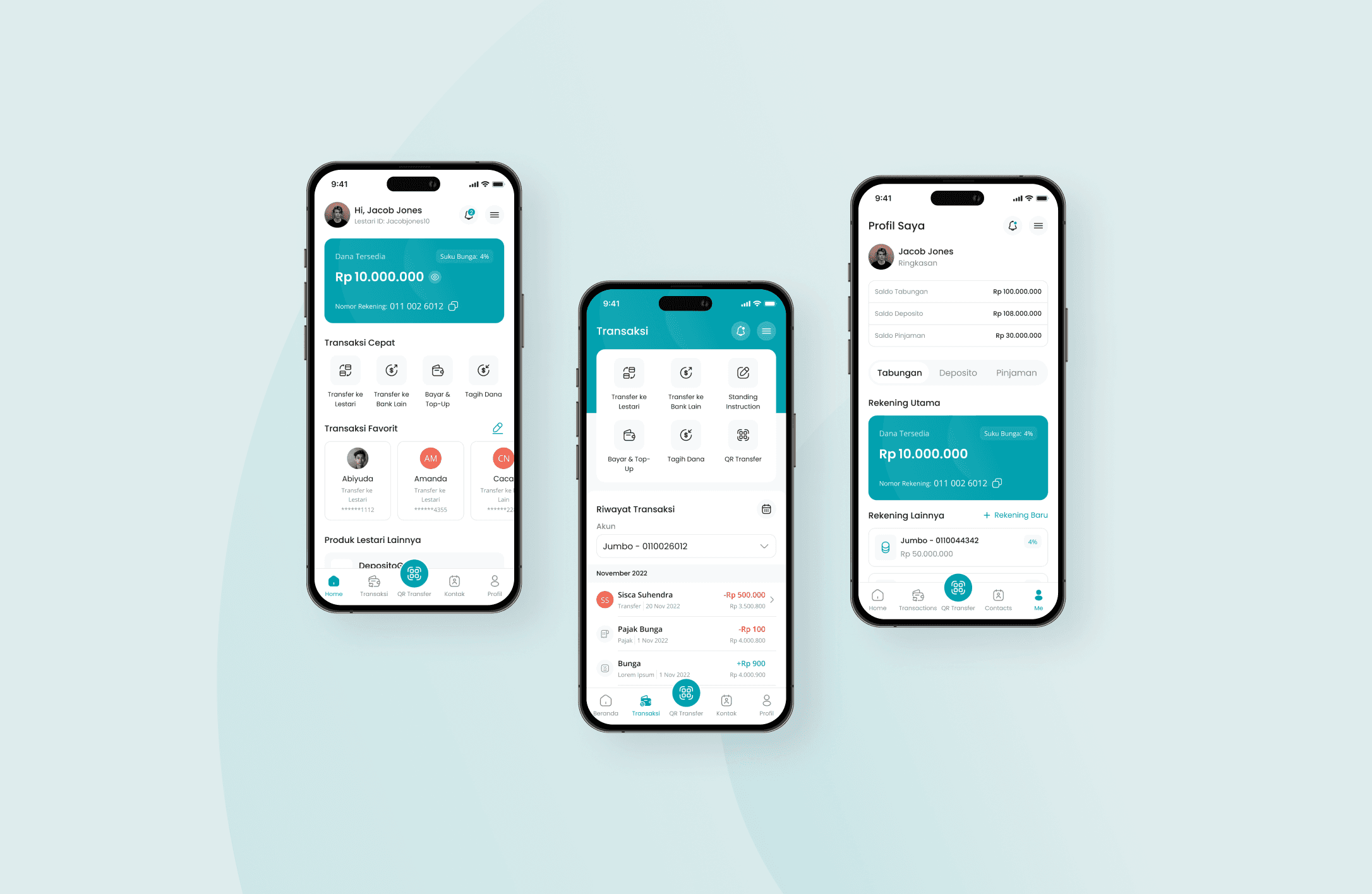

After months of researching and designing, we created LestariGo: digital-centric, community-focused banking.

Benchmarked against innovative digital-only banks, it is designed to be optimized for transactions and have the look and feel of a digital-first company. However, it still retains the DNA of a rural bank by emphasizing its ability to be an investment vehicle for customers and a business partner for small businesses.

LestariGo is intended to be rolled out to 30,000+ users in 2024.

OUR SOLUTION

core features

Lestari is not a technology company—but with targeted, focused strategy, their app can make a big difference for their goals.

KEY PRODUCT STRATEGY

Live up to expectations.

Matching the expectations of today's users with a transaction-focused, modernized interface.

1

The low-hanging fruit

No-friction onboarding.

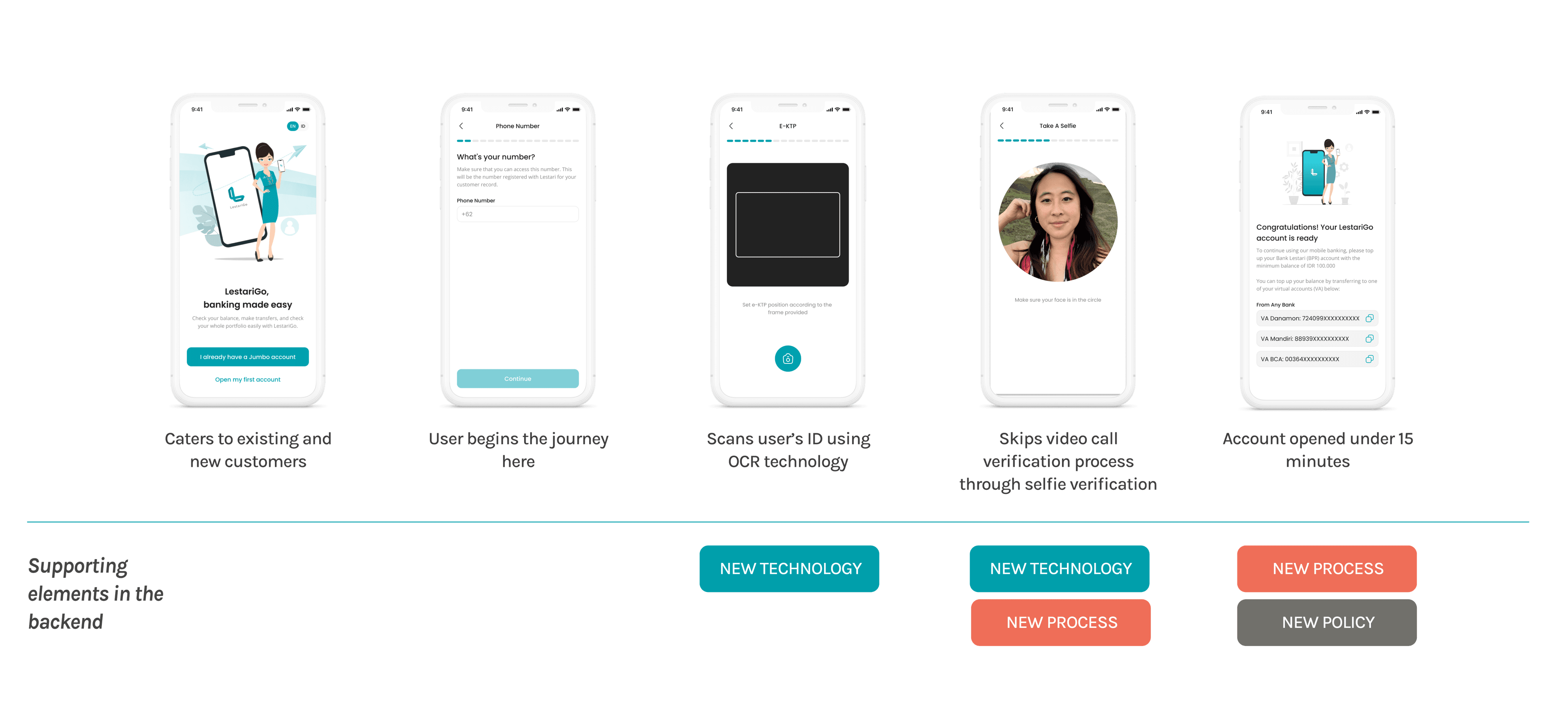

Shifting to a fully online onboarding process to reduce friction for new and potential users.

2

The obvious... but hard

We're a rural bank first.

Leaning on Lestari's competitive advantages as a rural bank to provide differentiation in a crowded space.

3

The key one!

Live up to expectations.

Matching the expectations of today's users with a transaction-focused, modernized interface.

strategy 1

Users are increasing their expectations from their banking solutions, especially with the new digital banks entering the market. The interface revamp aims to signal Lestari's commitment to being a serious player in the digital space and offer a more positive experience for users.

Optimized for transactions

No-friction onboarding.

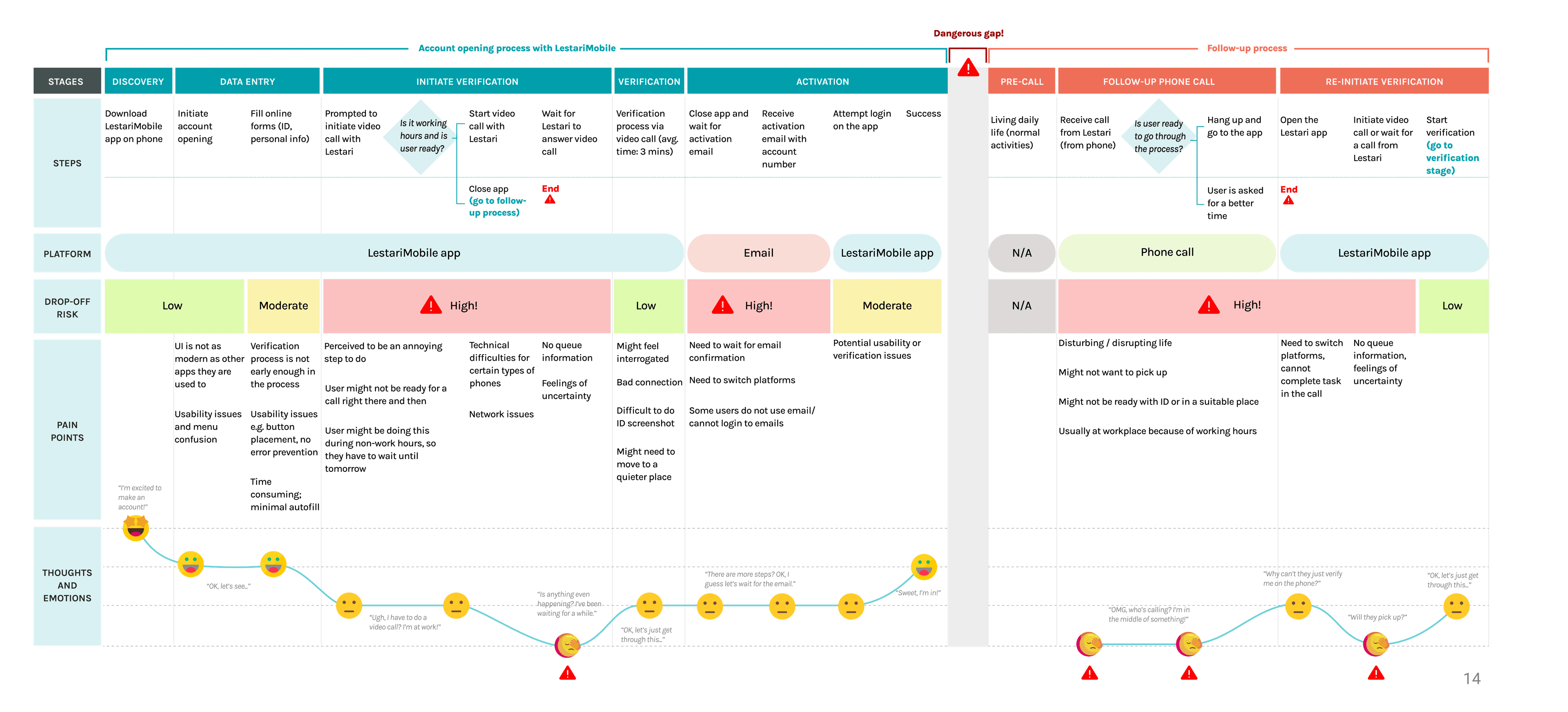

strategy 2

The majority of my research is concentrated here - read my design process below for more details!

Shifting to a fully online onboarding process to reduce friction for new and potential users.

The previous onboarding process is clunky with many drop-off risks, and very inconvenient for users. Since Lestari is likely not going to be a user's primary bank and users have many other options, reducing friction when onboarding a potential new customer is top priority.

We're a rural bank first.

strategy 3

Leaning on Lestari's competitive advantages as a rural bank to provide differentiation in a crowded space.

Indonesians are trying to navigate the digital revolution, much like the banks. They are anxious about the new names in the market but are inevitably drawn to the convenience and novelty offered by digital banks. But—with Lestari's strong presence in the community and existing reputation, maybe they can offer the best of both world.

Lestari will be phasing out their current app and rolling out LestariGo to 30,000+ users in 2024.

IMPACT

This project also called for interesting conversations within the organization beyond the product itself, leading to pretty important organizational impact:

As part of the work to create a seamless onboarding process, the design process resulted in:

Implemented improvements at the service call center to address employee pain points

Acquisition of new technological capabilities to enable a KYC process

Revisions to the Standard of Procedures (SOP) to be more human-centered

Re-examination and improvement of the new account opening process.

As part of the process of representing Lestari's banking products on the app, the design process resulted in:

Strategic leadership meetings to discuss the company's complete product portfolio

Workshops to revisit each product's market positioning, value proposition, and its strategic value to the company

A business decision to "split" an existing savings product into 2 distinct products

Company-wide alignment on the business' overall product portfolio.

To me, this really highlighted the superpower of design! No one expected these outcomes to be a part of the project.

Read my design process below

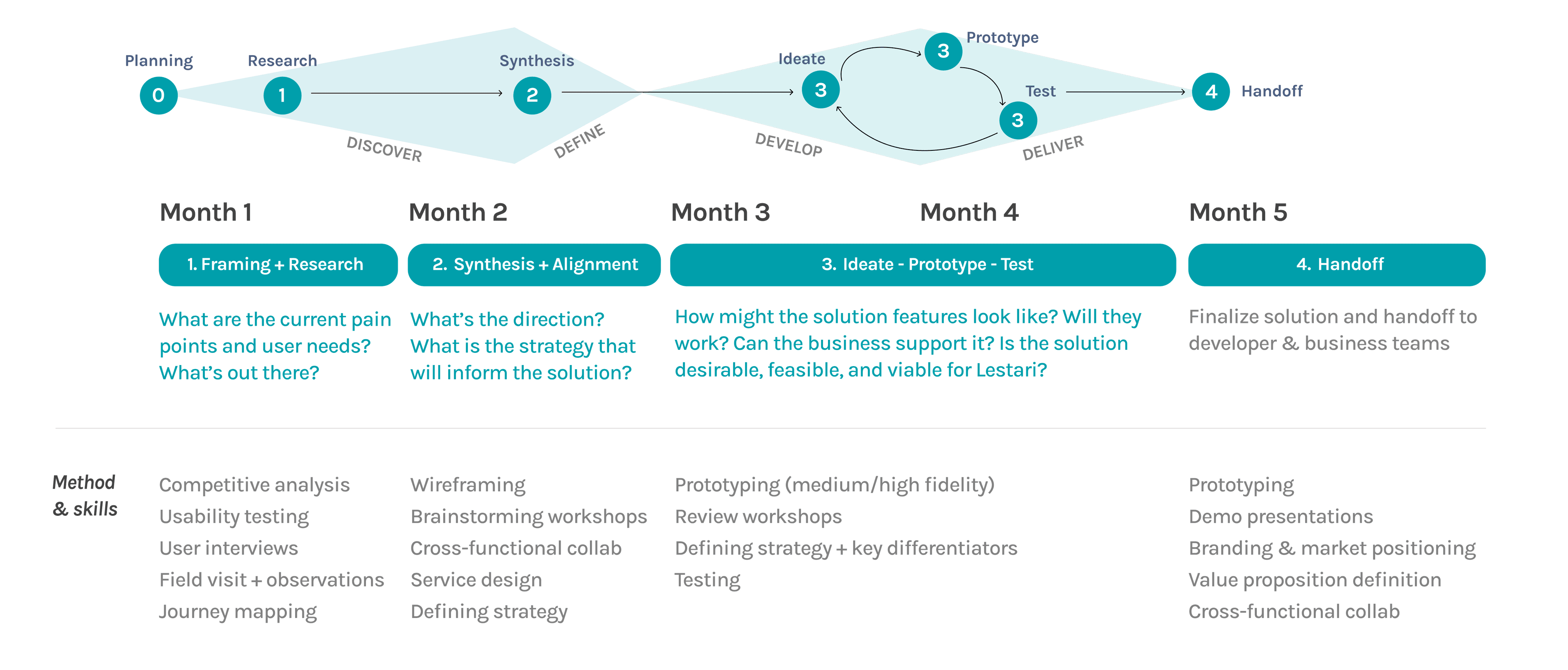

MY DESIGN PROCESS

I went through this loop for every feature

This is where my UI and visual designers came in

CONTEXT

Before diving in, I knew there were some constraints that

I had to keep in mind...

I'm working with a pretty tight timeline.

This project was part of a larger initiative (the redesign of the core banking system) and we were using the same contracted engineering team for the app development. What did that mean for me? I only had 6 months to deliver a design that can be developed.

My team is really small.

When I joined, the core design team was just… me. Recognizing that I could not take on this task alone, I had to make a case to my client that we would need to hire another visual/UI designer while I wrestled with the strategy and UX.

Lestari has minimal design capabilities.

User research and testing are not something that my client had the resources and budget for. This meant there would be constraints in recruiting for user research and limited ability to test our solutions with real users. So, I had to get creative in the research and evaluation process.

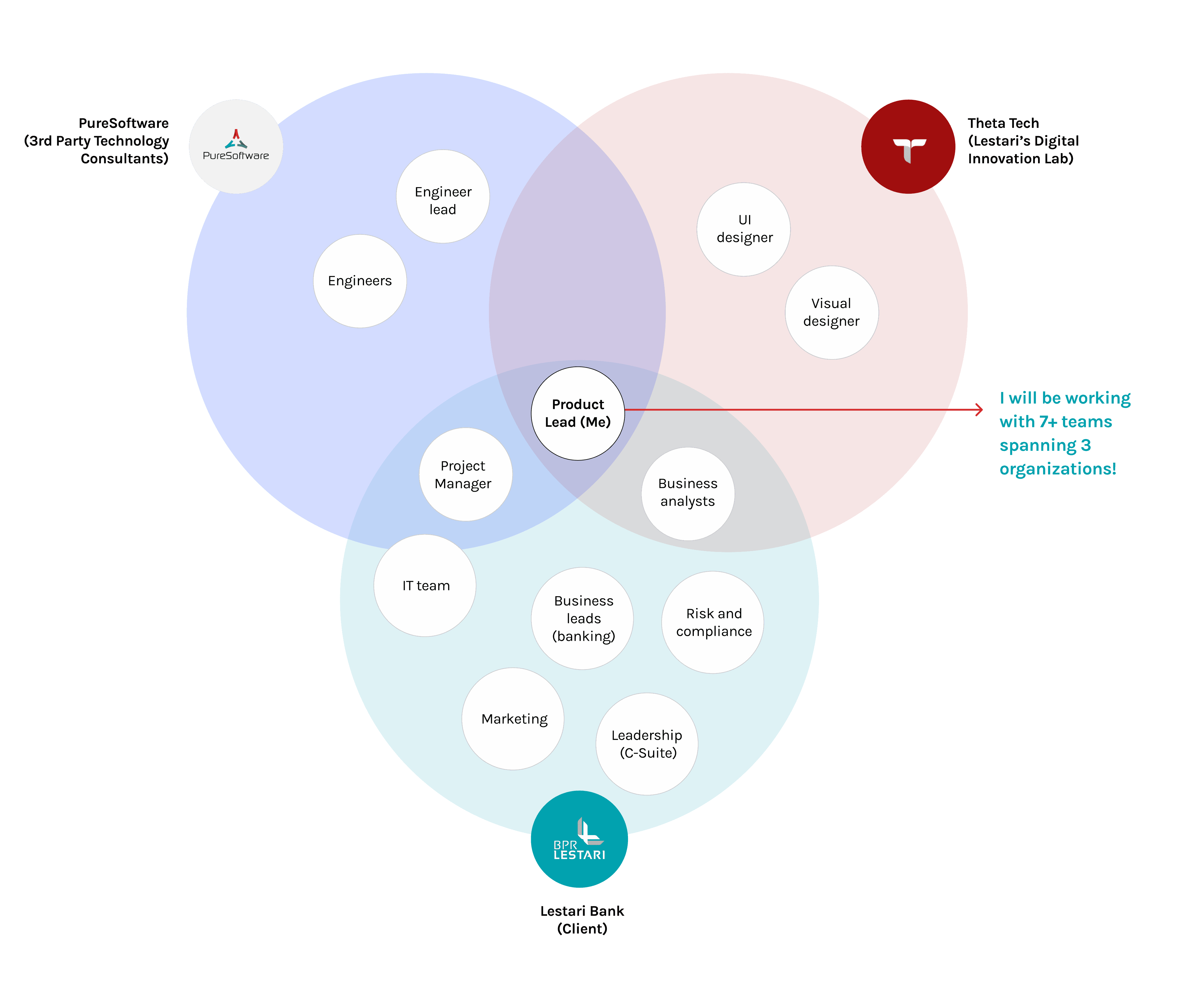

I will also be working with lots of different people, across organizations.

While this was daunting, I knew I can leverage my cross-functional skills that I've learned during my time in consulting!

RESEARCH

I had a lot of questions and there are important context to understand before I can start to re-design.

What are the current user pain points?

What's the current journey of opening an account with Lestari?

What are the user needs and expectations?

What banking apps do people have and why?

What is out there in the market? Is it working?

How do people feel about banking, and why?

Why would someone want to open a new bank account?

Note: I was also asked by the client to specifically look at the new account opening process

research plan

A 3-part research plan to answer some of these questions.

research

questions

to answer

steps

Competitive analysis + benchmarking

What is out there? What is working and what is not? And how does Lestari compare to them?

Explored 6 top mobile banking apps in the market, comparing them with LestariMobile (current app)

What is it like to try to open a new account? What are the pain points? What are people's perception to banking, what do they need/expect?

Observed 4 new users open a new account using LestariMobile, followed by an interview

New account usability study + semi-structured interviews

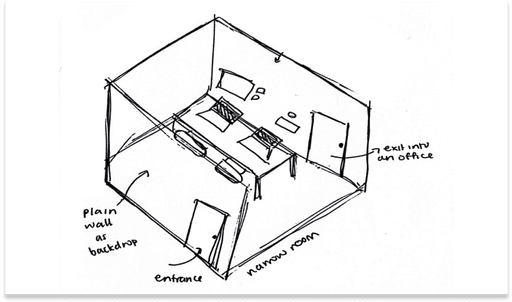

What are the real contexts of users when they try to open a new account? What is it like to support this process from Lestari's employee's POV?

Observed video call requests as part of current onboarding process, followed interviewing the customer service agents

Field visit to Lestari's customer service call center

Research unveiled that Lestari's current onboarding process is rife with drop-off risks.

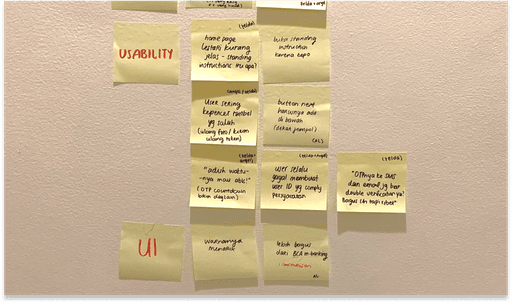

research findings

I asked participants to attempt to create an account with Lestari with the current app. While it was usable for most participants, the experience was disjointed and there was much room for improvement—especially when you consider the real-life contexts of users when opening a bank account.

Users are trying to fit this onboarding process into their day-to-day life

(this means they are at work, running errands, etc.)Getting phone calls or being prompted to do a video call create life interruptions

Most users work 9-5 jobs and have trouble setting up accounts outside of working hours (although this is the most convenient time to do so).

Simple, thoughtful design fixes on the interface can greatly minimize confusion and hesitation in users during onboarding

Some things we hadn't considered before…

During my field visit to the call center, I saw a customer service agent trying to do the verification process via video call with a user who was in the middle of selling fruits at a market.

OK, so the onboarding needs an overhaul. But beyond the nitty-gritty details, how do users feel about digital banking?

Just like the banks, Indonesians are trying to navigate this digital banking revolution too. There's a lot of anxiety, but also intrigue.

I'm scared and anxious.

Users find dealing with banks (especially digital banks) scary and uncomfortable. Their first reactions are to be hesitant to experiment beyond the norm.

“I only have an account with (redacted) because I'm afraid to try new banks.”

“What happens if they just shut down? They don’t even have an office!”

Need to be easy!

With technology and culture of ultra-convenience, users (esp. younger ones) are less tolerant to friction. If it’s frustrating, they won’t stick around.

10% of current Lestari potential customers give up during account onboarding

“It’s a lot of hassle to deal with banks. I hate them so much!”

Hmm, but I can't resist.

Given all of the enticing alternatives available and existing anxiety, users need extra clear reasons to open a new account with a bank. But hey, if it’s interesting. . .

“I opened an account with (redacted) because of their promotion deals.”

“I wanted to open an account with Lestari because of the discounts in the loyalty program.”

THE QUESTION BECOMES…

How might we design a digital-first, easy-to-use mobile banking experience while capitalizing our roots as a rural bank—an identity that might ease the anxieties of users?

IDEATION + ALIGNMENT

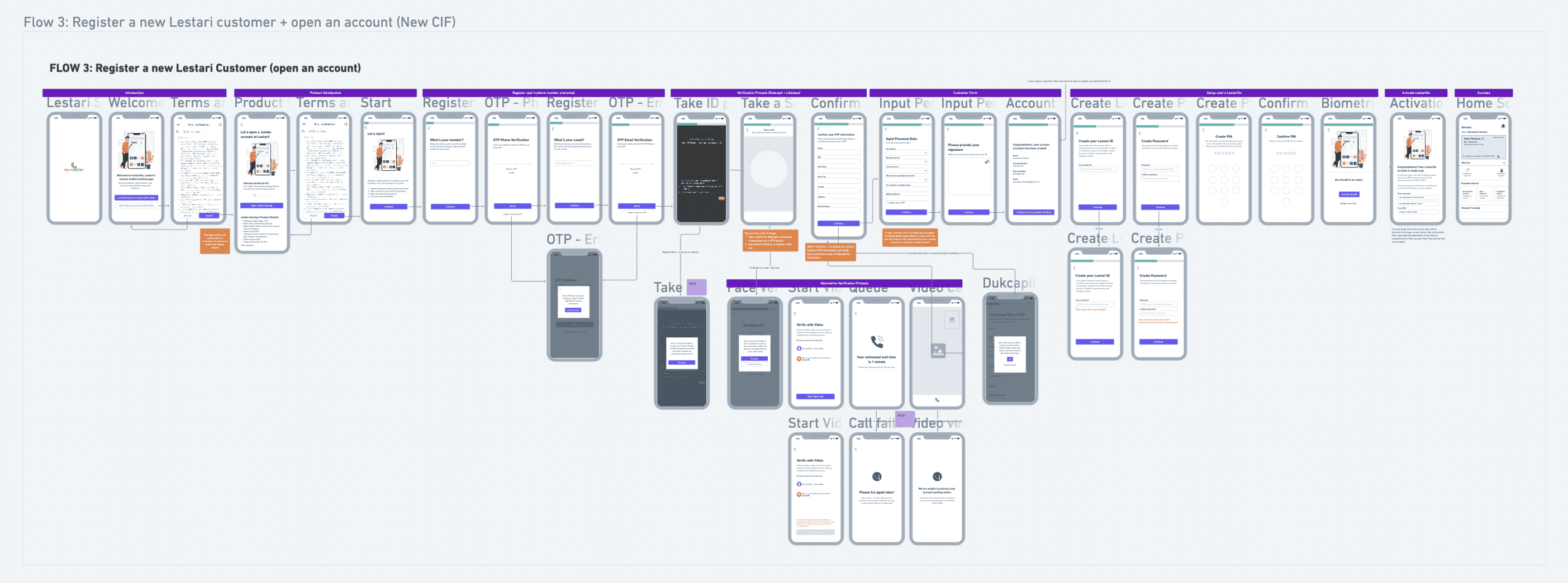

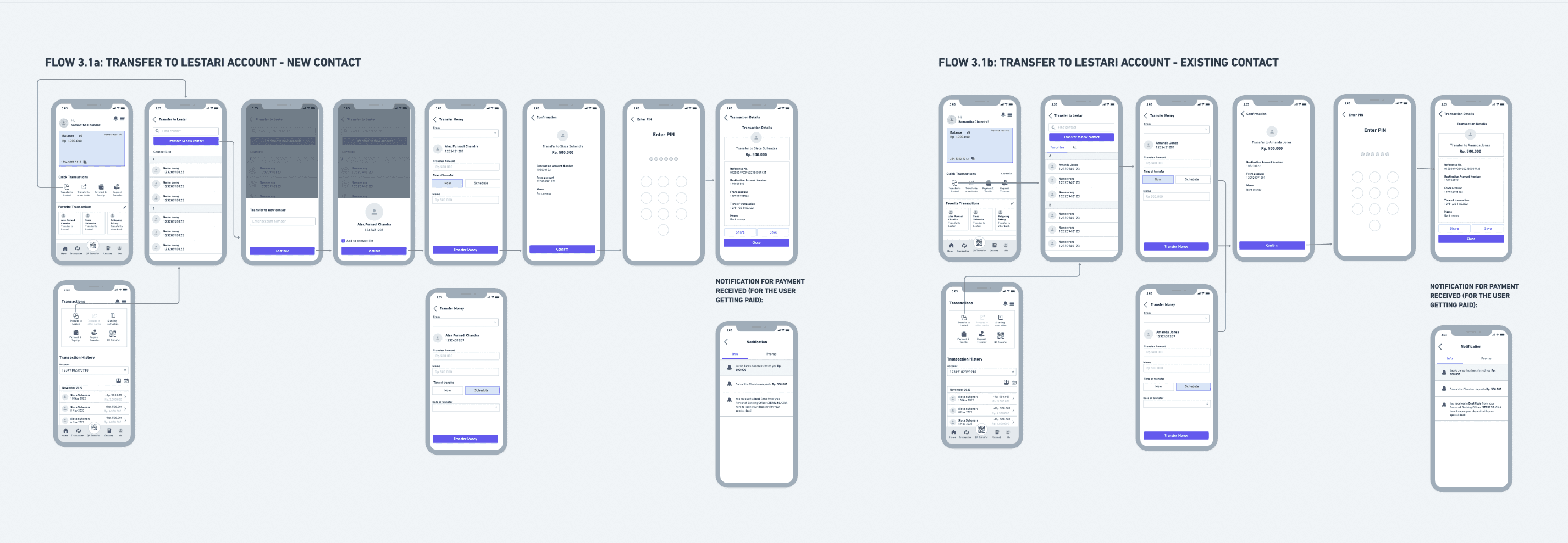

I created wireframes using Whimsical to explore concepts, flows, and features. The wireframes serve as two main purposes in our design process:

To get alignment from business, IT, and marketing teams on feature ideas through brainstorming and share-out sessions

To be a starting point for my UI designers to start designing the user interface

initial concepting

Aimed for a wide variation of initial ideas for discussion

brainstorming with core team

Discussed ideas and direction with my core team, consisting of from business and IT stakeholders at Lestari

final wireframes creation

Based on the results of the brainstorming , I created the final proposed flow with wireframes

final review with stakeholders

Once a group of flows are done (e.g. a feature), I hold a review session with stakeholders for buy-in and to capture final revisions

handoff to UI designers

The approved wireframes are then handed off to my UI design team to be polished into screens for development

A lot of concepts, a lot of workshops.

my process

workshops

screens wireframed

teams

10+

120+

7

TESTING

How do we test our ideas in an organization with limited testing capabilities?

Our final concept!

review sessions

stakeholders

5

30+

interactive flows

50+

While testing each concept and feature with real users were not feasible for this project, we leveraged employees like customer service agents and bank tellers who talk with Lestari customers and mobile banking users daily. As a result, we were able to tap into their deep understanding of user mindset, pain points, and likely reactions to the featured concepts.

My learnings and reflection

With our learnings in mind, we began the design of our first product

When working cross-functionally with multiple stakeholders, alignment is incredibly important

Sometimes, all it takes is just to put everyone in the same room (if possible). Things like taking good meeting minutes, transparent communication, and regular touch points become very important.

01

Understanding business and process constraints when working with larger organizations with tight regulations

As designers, it is easy to be idealistic about how the "dream product" would look like. However, designers must also understand real-life constraints that can make ideas unfeasible to implement.

03

With multiple rounds of revisions, changes in decisions can get overwhelming and must be managed

If I were to redo this project again, I would have implemented a better change management system to keep track of decisions, agreements, and changes made to the product.

02

When there is not much time for user research and testing, get resourceful to test validity of ideas

As Lestari had little user research capabilities and time was limited, I relied on internal employees, like customer service agents and business unit managers who could be the voice of future users.

04

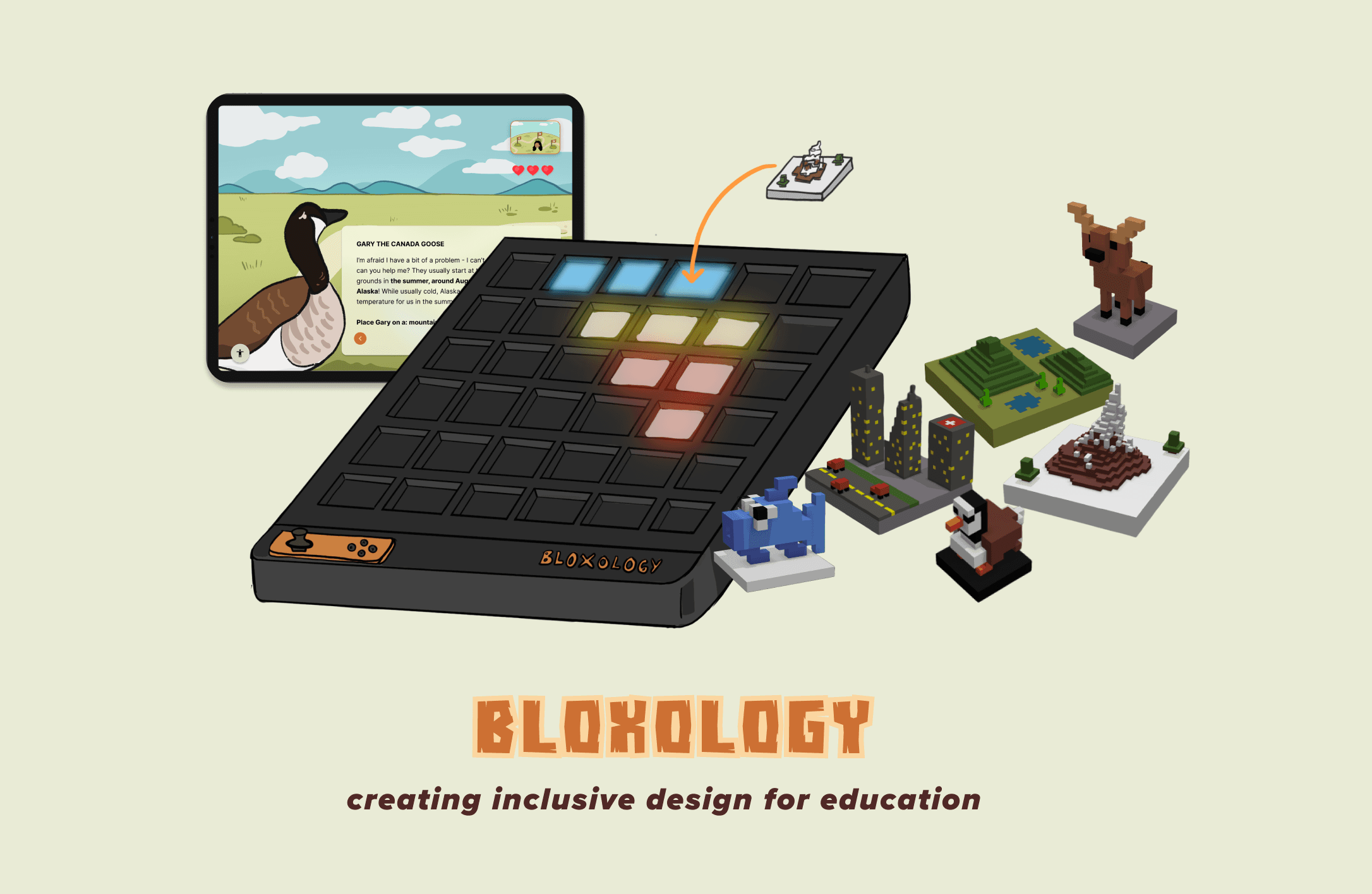

Prototyping a fun, immersive, and inclusive lesson to teach animal migration to 5th-grade students through a digital and physical gaming experience

Bloxology

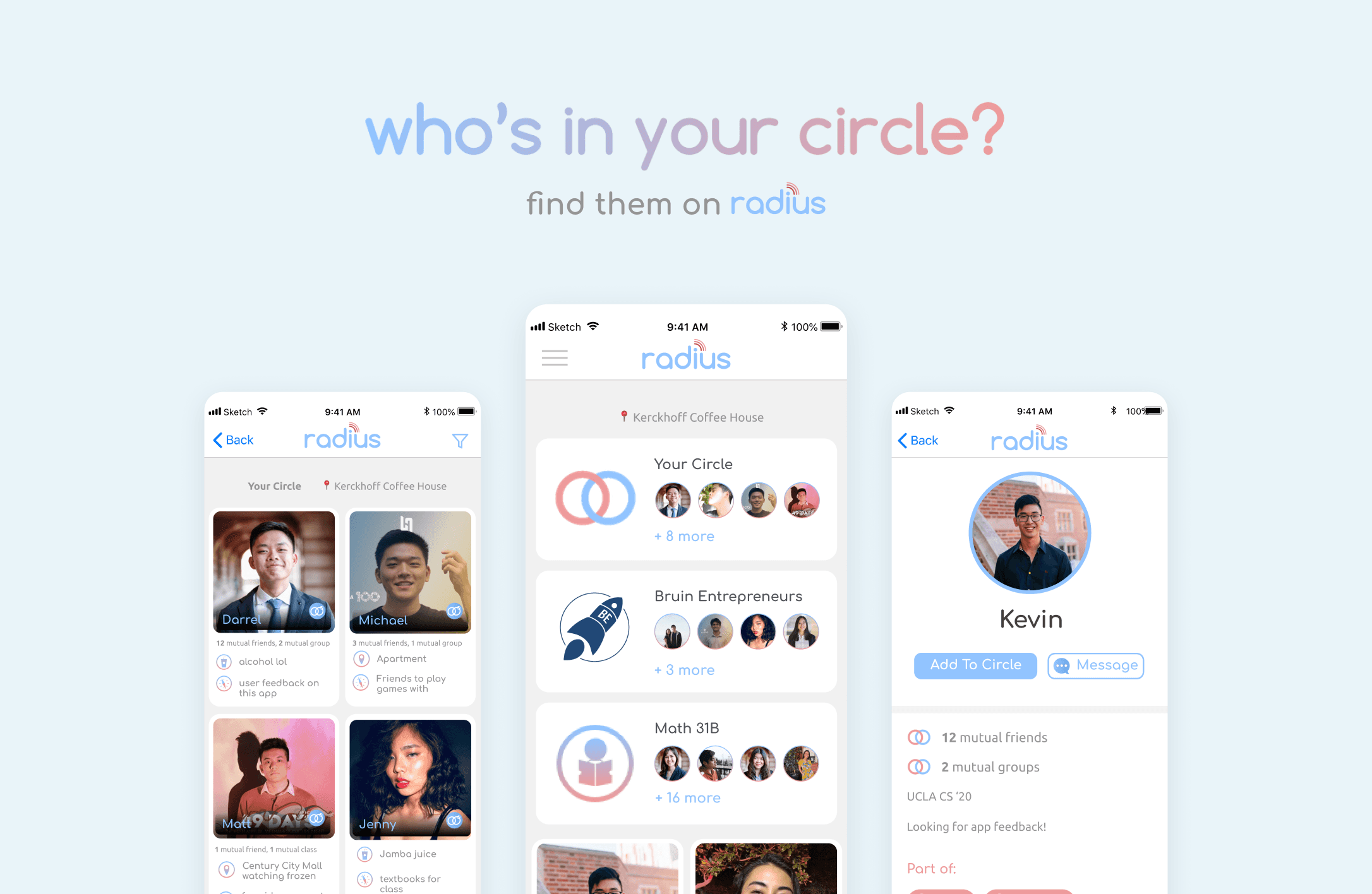

Leading customer discovery and UX research for a location-based social media startup at a college campus of 32,000+ students.

Radius

See more projects

@ 2023 Samantha Chandra